🎧 Listen to This Article

In the heart of Washington D.C., Donald Trump made a significant announcement on March 6, 2025, regarding tariffs on imports from Canada and Mexico.

The President has temporarily paused tariffs on certain goods from these neighboring countries, contingent on compliance with the United States-Mexico-Canada Agreement (USMCA).

This decision is expected to affect roughly 38% of Canadian and 50% of Mexican imports and will remain in effect until April 2.

While this tariff pause was intended to ease trade tensions, it appeared to have little positive impact on investor sentiment.

Major U.S. stock indices, including the Nasdaq Composite, faced declines, marking a shift as the market entered correction territory.

The tech-heavy index notably relinquished all gains achieved after the recent presidential election.

What You Need to Know Today

Tariff Pause Details

The decision to pause tariffs on select goods imported from Canada and Mexico comes amid ongoing discussions regarding trade practices.

The temporary exemption is designed not only to comply with USMCA but to maintain amicable trade relations while avoiding further economic strain.

Export Growth in China Stalls

In China, export growth has slowed considerably, with figures for January and February showing a mere 2.3% increase in U.S. dollar terms, well below expectations of 5%.

Amidst this backdrop, China’s Foreign Affairs Minister Wang Yi urged the U.S. to avoid imposing arbitrary tariffs and highlighted the importance of peaceful coexistence between the two nations.

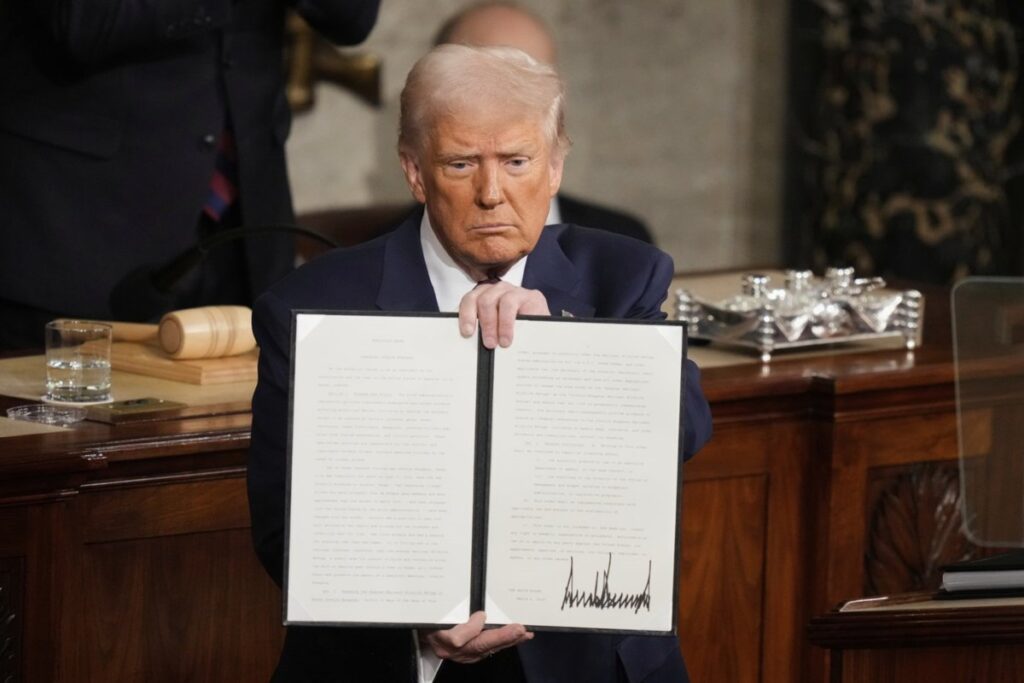

U.S. Establishes Strategic Bitcoin Reserve

In a notable move towards digital currency, President Trump announced the creation of a Strategic Bitcoin Reserve through an executive order.

This reserve will be funded with bitcoins seized in law enforcement actions, alongside a managed U.S. Digital Asset Stockpile for other confiscated cryptocurrencies.

Following this announcement, Bitcoin prices dipped, disappointing investors who anticipated a public purchasing initiative from the U.S. government.

Trump Addresses the Markets

When questioned about the impact of tariff decisions on the stock market, Trump stated he was “not even looking at the market,” which caused concern among investors.

He indicated confidence in the long-term strength of the U.S. economy while attributing recent declines to “globalist countries and companies.”

Treasury Secretary’s Insights

During a speech at the Economic Club of New York, U.S. Treasury Secretary Scott Bessent asserted that access to inexpensive goods isn’t the essence of the American dream.

He noted that Trump views tariffs as beneficial for generating government revenue, protecting domestic industries, and enhancing negotiation capabilities.

Layoffs on the Rise

February saw a concerning spike in layoffs, with U.S. companies reporting 172,017 job cuts—235% more than the previous month.

This figure represents the highest count since July 2020, largely influenced by cuts associated with federal workforce reductions.

Markets React to Tariff Fluctuations

U.S. stocks experienced significant declines due to growing fatigue over ongoing tariff discussions.

The S&P 500 dropped by 1.78%, with the Dow Jones Industrial Average losing 0.99%.

The Nasdaq’s 2.61% drop not only placed it in correction territory but also erased all recent post-election gains.

Asian markets mirrored this trend on Friday, with Japan’s Nikkei 225 falling sharply.

European Central Bank Takes Action

In response to economic conditions, the European Central Bank announced a 25 basis point reduction in interest rates, lowering the key deposits facility rate to 2.5%.

This move aligns with a shift toward a “less restrictive” monetary policy, indicating an adaptation to evolving economic challenges.

Conclusion

Traders and investors are closely monitoring updates to President Trump’s trade policies while global economic trends continue to shift.

As the financial landscape evolves, understanding these tariff changes and economic signals will be essential for navigating forthcoming market conditions.

For further details, clarification, contributions or any concerns regarding this article, please feel free to reach out to us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that all inquiries will be handled in accordance with our privacy policy