🎧 Listen to This Article

In a significant development for the cryptocurrency industry, the Senate cast votes on Tuesday aimed at overturning two contentious regulations introduced during the latter part of the Biden administration. This legislative effort seeks to alleviate perceived burdens on financial innovation within the crypto sector.

Why This Matters:

The regulations in question include the IRS’ recently enacted DeFi broker rule and the digital payments rule from the Consumer Financial Protection Bureau (CFPB). These measures have been criticized by crypto advocates as overly restrictive and detrimental to the growth of digital finance.

Both repeal initiatives utilize the Congressional Review Act (CRA), which grants Congress limited power to revoke rules established by outgoing administrations. This approach reflects a pattern seen under the previous Trump administration, which similarly rolled back several regulations from the Obama era.

Recent Legislative Actions:

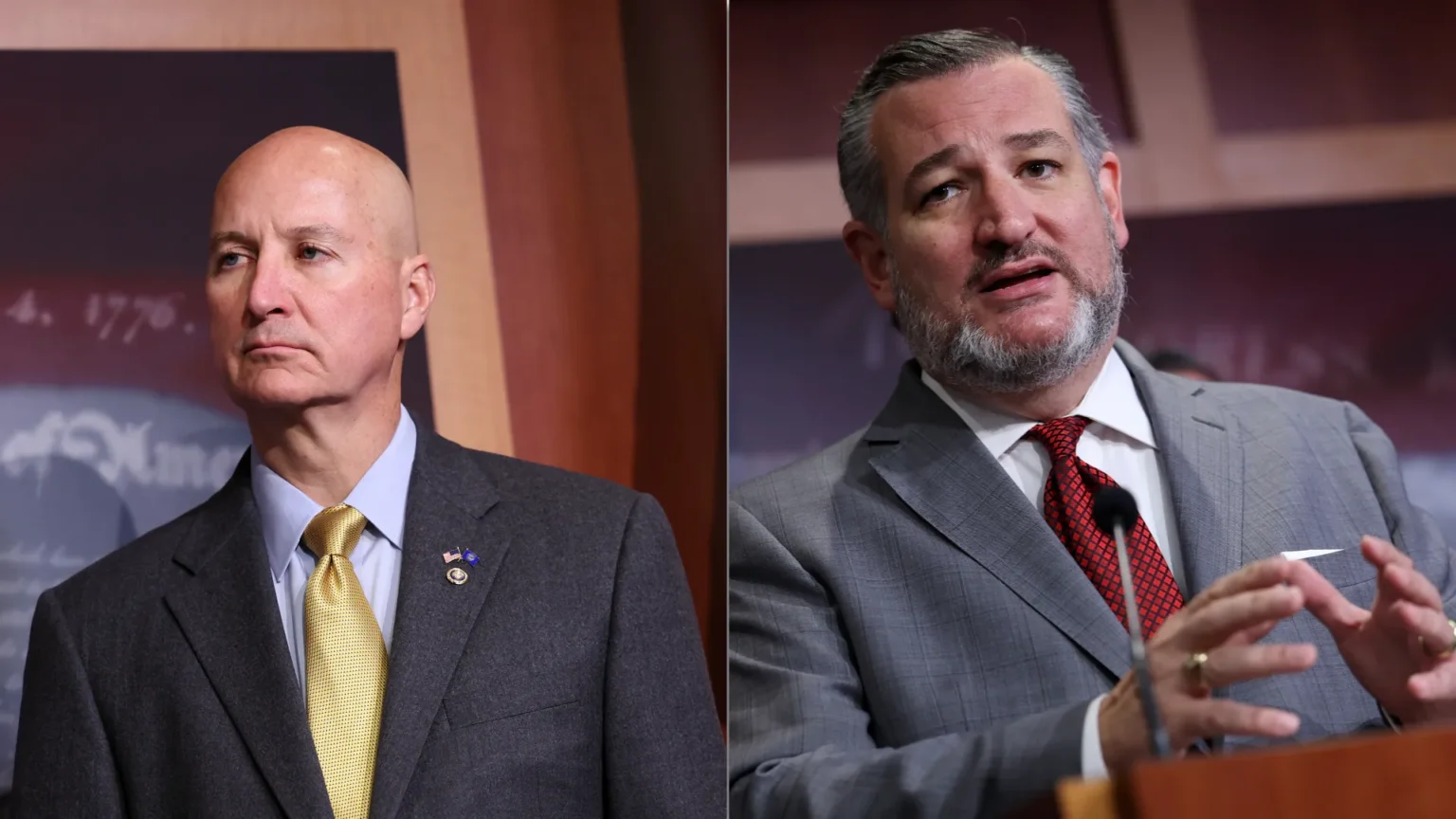

The Senate successfully passed the CRA resolution that aims to repeal the IRS DeFi broker rule, with the vote tallying at 70 to 27. The resolution was championed by Senator Ted Cruz (R-Texas) and has garnered support from the Trump administration.

- The IRS rule is intended to enhance revenue collection from cryptocurrency trading by broadening its reporting requirements to encompass automated operations functioning on decentralized platforms.

- This expansion has been labeled “technologically unfeasible” by Coin Center, a prominent think tank focused on digital assets.

In addition to the IRS rule repeal, the Senate also approved a procedural motion to advance a second CRA resolution targeting a January rule from the CFPB. This rule has raised the agency’s authority to regulate financial technology applications involved in payments.

- Introduced recently by Senator Pete Ricketts (R-Nebraska), a final vote on this measure is anticipated in the Senate on Wednesday.

Understanding the CFPB’s Expanded Authority:

The implementation of fintech applications has surged in popularity across the United States. The CFPB’s new rule expands the responsibilities under the Electronic Funds Transfer Act to encompass “non-custodial” cryptocurrency wallets.

- A major concern among developers of these wallets is the inability to comply with regulatory obligations, as they do not have control over the assets stored within them.

- Legal experts from Perkins Coie have highlighted this challenge in discussions about the new rule.

Diverse Perspectives:

Supporters of the CFPB rule, including the advocacy group Better Markets, argue that the regulation is necessary for consumer protection.

- Stephen Hall, legal director of Better Markets, stated last year, “The CFPB’s proposal will … protect the wallets of the rising number of Americans using these technologies.”

Statements from Senate Leadership:

Senate Majority Leader John Thune (R-South Dakota) criticized the Biden administration for what he described as efforts to “stifle financial innovation in the United States” and emphasized the importance of dismantling these regulations to reinstate financial freedom for Americans.

As the Senate continues to push for reform, the focus remains on striking a balance between regulatory oversight and promoting the growth of the cryptocurrency industry in a rapidly evolving financial landscape.

For further details, clarification, contributions or any concerns regarding this article, please feel free to reach out to us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that all inquiries will be handled in accordance with our privacy policy