🎧 Listen to This Article

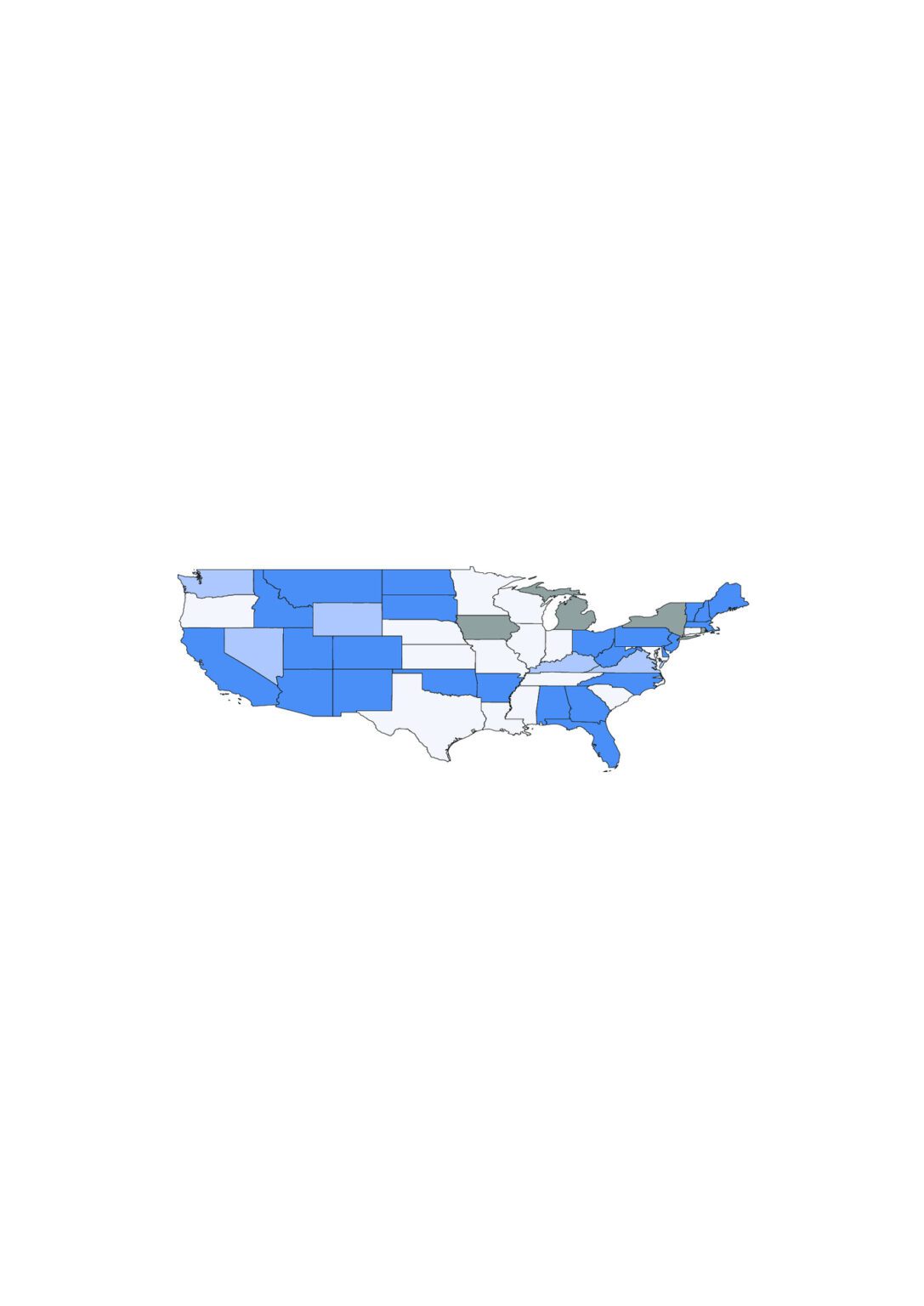

Are sky-high property taxes draining your budget—or barely a blip on your radar? In 2025, U.S. households fork over an average of $2,969 annually in property taxes, but where you live could mean the difference between a financial burden and a breezy bill. WalletHub’s latest crunch reveals the states with the heaviest and lightest tax loads, spotlighting a gap that’s got homeowners buzzing. “Some states hit you hard, others let you off easy,” says WalletHub analyst Chip Lupo, hinting at a tax divide shaping relocation dreams. Curious if your state’s a tax trap or a haven? Let’s break it down.

The 2025 Property Tax Landscape

A Tale of Highs and Lows

Property taxes fuel local governments—think schools, roads, and fire departments—but their bite varies wildly. WalletHub’s 2025 report, sourced from U.S. Census Bureau data, pegs the national average at $2,969 per household. Yet, some states soar past $8,000, while others dip below $1,800, per their analysis. “It’s not just homeowners—renters feel it through higher rents,” Lupo notes, echoing Census insights that $617 billion in property taxes powered 39% of state and local revenue in 2019.

Top 5 Tax Heavyweights

These states pack the biggest punch, per WalletHub’s effective tax rate rankings:

- New Jersey: 1.64% rate—$8,432 median bill, per Census data.

- Illinois: 1.88%—highest in the U.S., with hefty tabs in Lake County.

- Connecticut: 1.54%—steep costs in high-value regions.

- New York: 1.46%—Nassau County tops $10,000, per ACS estimates.

- Nebraska: 1.46%—a Midwest surprise with rising levies.

Top 5 Tax Lightweights

These states offer sweet relief, per WalletHub:

- Hawaii: 0.31%—lowest rate, despite high home values, per Census.

- Alabama: 0.42%—$1,715 median, a Southern steal.

- Colorado: 0.48%—low rates, high income soften the blow.

- Nevada: 0.48%—Vegas keeps taxes lean.

- West Virginia: 0.49%—cheapest homes, lightest load.

Economic and Homeowner Impacts

The tax divide ripples through wallets and economies. In New Jersey, homeowners shell out $8,432 yearly—over 2.5 times the national average—straining budgets in a high-cost state, per Census figures. Illinois follows, with 1.88% rates pushing bills skyward, per ATTOM Data Solutions. “It’s a major burden,” Lupo says—yet Hawaii’s 0.31% keeps even high-value homes affordable, per WalletHub stats.

For renters, landlords bake these taxes into leases—New York’s $10,000+ counties mean pricier rents, per ACS data, while Alabama’s $1,715 eases the pinch. States like New Jersey fund robust services, but at what cost? “High taxes could deter movers,” Lupo warns—pleasure lies in low-tax havens like Colorado, per economic analyses.

What This Means for You

Don’t let property taxes blindside you—here’s your game plan:

- Know Your State: Check WalletHub’s rankings—NJ bites, HI spares, per their report.

- Assess Your Bill: Use [Property Tax Estimator] to gauge your load—IRS data backs it.

- Explore Exemptions: Seniors, vets, or low-income? Local relief varies—see irs.gov.

- Plan Your Move: Eye low-tax states—AL or CO could save thousands, per Census stats.

Act now—your wallets at stake.

Conclusion: Navigate 2025’s Tax Terrain

In 2025, property taxes—averaging $2,969—split the U.S. into haves and have-nots. New Jersey’s $8,432 crushes, while Hawaii’s 0.31% soothes, per WalletHub’s crunch. “It’s a tax tale of two Americas,” Lupo told Reuters—high-tax states strain, low-tax ones lure. Dodge the burden or lock in savings—steer your 2025 tax fate today.

Is 2025 the Year for Property Tax Breaks? Texas Eyes $20 Billion Surplus Solutions

For further details, clarification, contributions or any concerns regarding this article, please feel free to reach out to us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that all inquiries will be handled in accordance with our privacy policy