🎧 Listen to This Article

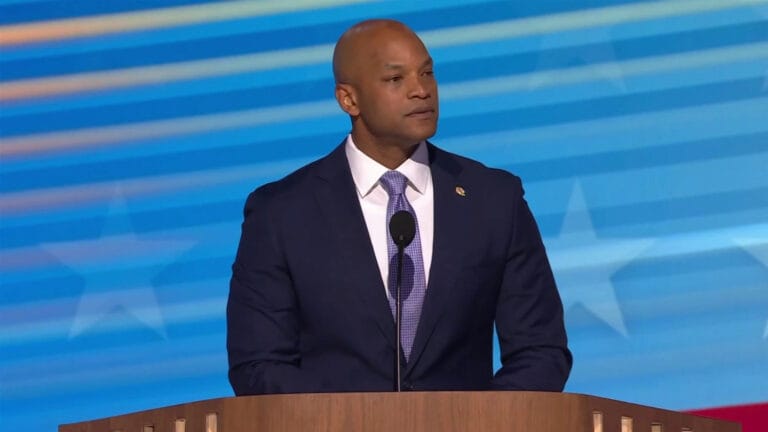

Gov. Wes Moore announces tax increases on IT services, wealthier residents, gambling, and cannabis, alongside budget cuts to stabilize Maryland’s finances.

Maryland Gov. Wes Moore and state Democratic leaders unveiled a budget framework introducing tax hikes and spending cuts to address the state’s $3.3 billion deficit. The plan includes new levies on IT services, capital gains, gambling, and cannabis, alongside a new income tax bracket for high earners.

Key Tax Changes in the Budget Deal

- 3% Tax on IT Services: Applies to website development, cloud storage, and other digital services.

- New Wealth Tax: Affects individuals earning over $750,000, requiring an additional $1,800 in taxes annually.

- Capital Gains Surcharge: A 1% tax on earnings over $350,000.

- Gambling & Cannabis Taxes: Increased rates to generate additional state revenue.

Political Fallout: Trump vs. Maryland Democrats

Moore blamed President Donald Trump’s tariffs and federal job cuts for worsening the state’s financial situation, citing Moody’s assessment that Maryland is at the greatest risk from federal downsizing. Republicans pushed back, arguing the deficit predates Trump’s administration.

House Minority Leader Jason Buckel criticized the plan, stating:

“All I took away from it was we’re increasing people’s taxes and making cuts, but we can’t tell you what those cuts are.”

How Will Marylanders Be Affected?

According to Moore, 94% of residents will see no change or a tax cut, though no details were provided on the estimated savings. Senate President Bill Ferguson framed the tax plan as a necessary modernization of revenue streams to align with a digital economy.

Next Steps

Lawmakers must finalize and pass a balanced budget by April 7. Moore called the deal a framework and expects further negotiations before signing the final version into law.

For further details, clarification, contributions, or any concerns regarding this article, please contact us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries