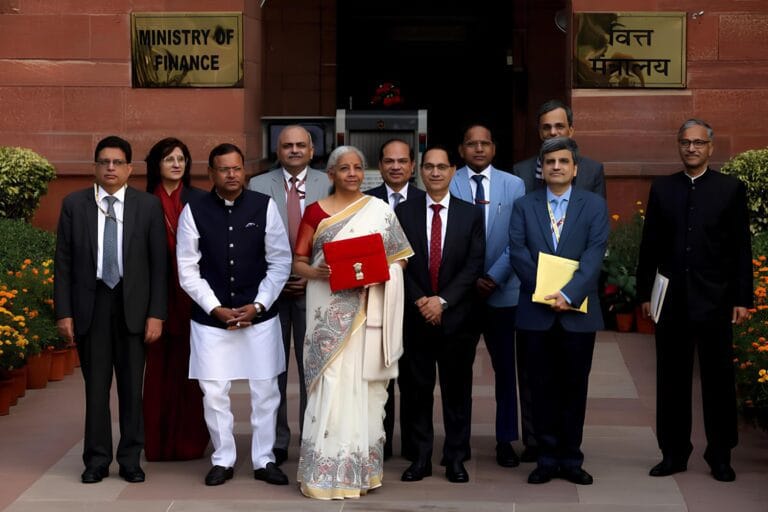

In a recent proposal, Finance Minister Nirmala Sitharaman announced a significant change that is likely to have a positive impact on various sectors, specifically targeting outbound tourism, education, and the airline industry.

The threshold for collecting Tax Collected at Source (TCS) on transactions under the Liberalized Remittance Scheme (LRS) will increase from Rs 7 lakh to Rs 10 lakh. Additionally, the 0.5% TCS on education-related remittances funded by loans will be eliminated.

This revised TCS threshold is expected to invigorate both the travel and foreign exchange sectors, facilitating easier and more cost-effective outbound travel.

With this adjustment, individuals will be able to remit larger amounts abroad without an additional tax burden, fostering growth in sectors reliant on international travel and education.

Understanding the Liberalized Remittance Scheme (LRS)

Under the LRS, residents—including minors—are permitted to remit up to USD 250,000 annually for various permissible transactions, including:

- Overseas education

- Medical treatment

- Property purchases

- Investments in foreign stocks

Poonam Upadhyay, Director at Crisil Ratings, emphasized that this tax adjustment should effectively stimulate the travel and foreign exchange sectors.

As a result, the outbound tourism and airline industries should see a beneficial trend moving forward.

Moreover, students seeking education abroad and individuals requiring medical care overseas will particularly benefit from this policy change.

Implications for Students and Travelers

Manoj Purohit, Partner at BDO India, added that the rationalization of the TCS levy will both expand the exemption base and enhance compliance.

The removal of TCS on educational payments via specified financial institutions will also significantly reduce administrative burdens for students planning to study abroad, simplifying their financial management.

Key Statistics on Outward Remittances

The numbers highlight the significance of these changes:

- During FY 2023-24, outward remittances under the LRS reached USD 31.735 billion.

- Travel alone accounted for over 50% of this outflow, totaling USD 17 billion, a stark increase from just 1.5% in FY 2014.

- Student remittances contributed USD 3.47 billion in FY 2024.

Clarification on TCS and Its Impact on Taxpayers

One critical point to note is that TCS does not constitute an additional tax liability, as individuals can claim a refund when filing their income tax returns.

The 2023-24 Budget proposed a TCS rate of 20% on overseas tour packages starting from October 1, up from the previous 5% rate.

Additionally, international credit card transactions will not be subject to TCS, as confirmed by HDFC Bank regarding the classification of such expenses.

Current TCS Rates for Education-Related Expenses

Loan-Funded Education Expenses

- No TCS applies to education-related funds from loans for amounts under Rs 7 lakh annually.

- For amounts above Rs 7 lakh, a 0.5% TCS rate applies.

Self-Funded Education Expenses

- Amounts under Rs 7 lakh remain exempt from TCS.

- Amounts of Rs 7 lakh and above carry a 5% TCS rate.

Conclusion: A Step Toward Economic Growth

The increase in the TCS threshold is set to streamline financial processes for many individuals seeking educational opportunities and international travel.

By reducing tax burdens, this policy shift is expected to boost economic activity in the travel, education, and foreign exchange sectors.

You might also want to know How Union Budget 2025 Will Revolutionize India’s Compliance System

For further details, clarification, contributions or any concerns regarding this article, please feel free to reach out to us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that all inquiries will be handled in accordance with our privacy policy