🎧 Listen to This Article

HANOI – Vietnam has offered to eliminate all tariffs on U.S. imports in a last-ditch effort to stop a sweeping 46% tariff that President Trump is expected to impose this week—a move that could jolt global supply chains and strain U.S.-Vietnam relations.

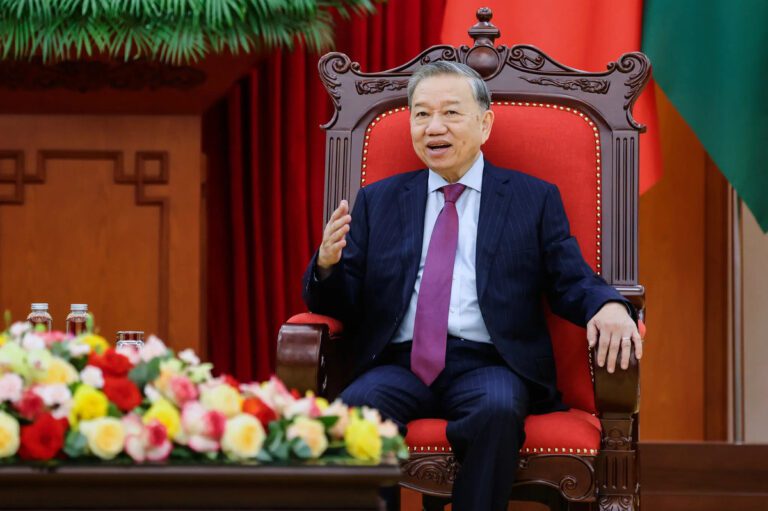

The dramatic proposal was delivered in a letter from Vietnam’s top leader, To Lam, to President Trump on Saturday. The offer follows a private call between the two leaders, which Trump later described as “very productive.”

The Stakes: $123B in Trade, Millions of Jobs, Rising Prices

A 46% tariff on Vietnamese goods—one of the highest ever proposed by the U.S.—could have ripple effects across major industries:

- American consumers could face higher prices on apparel, shoes, and electronics.

- Global brands like Nike, Adidas, and Lululemon—many of which manufacture in Vietnam—could see costs surge.

- Vietnam’s economy could contract by 5.5% of GDP, per ING.

The U.S. is Vietnam’s largest export market, accounting for nearly 30% of its total exports. A tariff of this scale could be economically devastating for the Southeast Asian nation, just as it seeks stronger U.S. ties to counterbalance China’s regional dominance.

Vietnam’s Offer: Tariffs to 0%, More U.S. LNG & SpaceX Deals

To stave off the tariff hike, Vietnam has offered:

- Zero tariffs on all U.S. imports (currently ~9.4% avg.)

- Appointing Deputy PM Ho Duc Phoc to lead emergency negotiations

- A potential summit in D.C. at the end of May

- Additional U.S. LNG imports & SpaceX partnership for Starlink rollout

- Permits for a $1.5B Trump Organization golf resort in northern Vietnam

But it’s unclear whether the Trump administration, which has leaned hard into nationalist trade policy, will take the deal. Trump has insisted that Vietnam is charging the U.S. “90%,” citing a $123.5B trade surplus, although the math behind the claim is disputed.

Trump’s View: “They Like Me. I Like Them.”

Despite the harsh measures, Trump has signaled goodwill, calling the Vietnamese “great people” and “great negotiators.” However, he’s made it clear he prioritizes trade balance over alliances.

“Trump doesn’t see allies or strategic value. He just sees numbers,” said Dr. Huong Le Thu of the International Crisis Group.

What This Means for Business & Trade

Manufacturers:

- May need to shift supply chains again, possibly to India or Mexico

- Could face sudden cost hikes on finished goods headed to U.S. markets

Retailers & Importers:

- Pricing models may be thrown off within weeks

- Inventory planning for Q3-Q4 could be disrupted

Global Trade Dynamics:

- Tariff escalation could reverse years of strategic cooperation between the U.S. and Vietnam

- Potential setback to U.S. efforts to counterbalance China in the Indo-Pacific

What’s Next?

Tariffs are set to take effect Wednesday. Vietnam has formally requested a 45-day delay to allow for negotiations.

If the U.S. proceeds, Vietnam would join China, Cambodia, and Laos as the hardest-hit countries under Trump’s latest tariff blitz. Observers say failure to reach a deal could significantly damage bilateral trust and push Vietnam closer to regional alternatives—including Beijing.

For further details, clarification, contributions, or any concerns regarding this article, please contact us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries