🎧 Listen to This Article

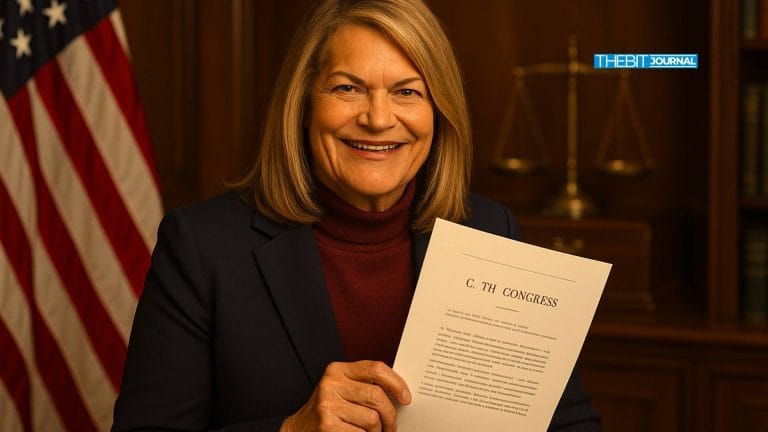

US Senator Cynthia Lummis (R-WY) has introduced a draft crypto tax reform bill aimed at simplifying and modernizing the tax treatment of digital assets in the United States. The proposed legislation comes after crypto-related amendments were excluded from the recent budget package.

The bill features several key provisions, including a de minimis exemption that would exclude digital asset transactions and capital gains of $300 or less from taxation, with a $5,000 annual cap on such exemptions.

Senator Lummis’ proposal also aims to:

- Defer taxation on crypto mining and staking rewards until the assets are sold.

- Exempt crypto lending agreements from immediate tax liability.

- Allow tax-free digital asset donations to qualified charitable organizations.

“This groundbreaking legislation is fully paid for, cuts through bureaucratic red tape, and establishes common-sense rules that reflect how digital technologies function in the real world,” said Senator Lummis. “We cannot allow our archaic tax policies to stifle American innovation.”

The bill is now seen as the Wyoming senator’s best opportunity to deliver on her longstanding promise of advancing pro-crypto legislation, following the exclusion of digital asset measures from the latest government spending bill.

Crypto Industry Pushes for Clarity

Tax treatment of digital assets has become one of the most contentious topics in Washington. Investors, developers, and traders have expressed frustration over unclear tax obligations, especially concerning staking, lending, and decentralized finance (DeFi) protocols.

In June, lawmakers on the House Financial Services Committee advanced a separate measure—the Digital Asset Market Clarity Act of 2025—that would exempt DeFi developers from being classified as money transmitters and shield them from some tax reporting requirements applicable to centralized exchanges.

With time running out before President Donald Trump’s expected signature on the spending bill, crypto supporters in Congress hope Lummis’ bill can reignite momentum for long-overdue tax clarity.

For further details, clarification, contributions, or any concerns regarding this article, please get in touch with us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries.