🎧 Listen to This Article

Opposition parties in the UK have voiced strong concerns about the newly proposed UK-India trade deal, claiming it could negatively affect British workers. One key aspect of the agreement involves an extension of an exemption on National Insurance contributions (NICS) from one year to three years for people on short-term visas. This exemption, known as the “double contribution convention,” means that workers on temporary transfers between the UK and India will not be required to make social security payments in both the country they work in and their home country.

Some have perceived the extension of this exemption as a potential threat to British workers, particularly given that UK National Insurance contributions have recently increased. Critics argue that Indian workers might become more cost-effective to hire than their British counterparts because employers would not need to contribute to their National Insurance during their three years working in the UK. The Indian government has hailed the deal as a “huge win” for Indian service providers, saying it will make them more competitive in the UK market.

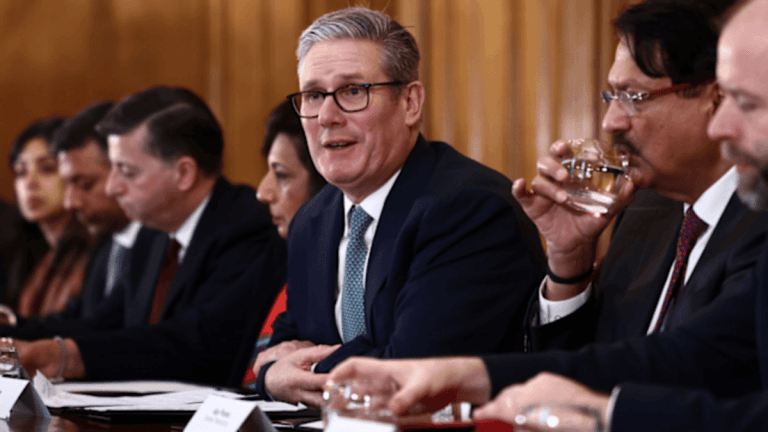

Business Secretary Jonathan Reynolds defended the trade deal, emphasizing that the exemption was narrowly applied to inter-company transfers of professionals between the UK and India. He reassured the public that those benefiting from the exemption would still pay income tax and the NHS immigration surcharge. British workers in India would also enjoy the same exemption under the deal. Reynolds believes the net effect of the agreement will be positive for the UK Treasury, helping to boost the UK economy.

Despite these assurances, opposition politicians, including Conservative leader Kemi Badenoch and Liberal Democrat deputy leader Daisy Cooper, criticized the deal. Badenoch, who had previously rejected a similar trade-off while she was business secretary, argued that the double taxation agreement with India was “unfair” because it would benefit Indian workers but not provide the same advantages for UK citizens working in India. She argued that this made the deal “lopsided” and potentially harmful to the UK’s economic interests.

Cooper went further, calling the National Insurance changes “half-baked” and warning that the deal could undermine the competitiveness of UK businesses. She suggested this could be particularly damaging given the global trade uncertainties caused by the trade war between the US and other nations.

In contrast, Labour Party representatives have defended the trade deal, arguing that the tax exemption would not apply to Indian nationals applying for jobs in the UK. A Labour spokesperson emphasized that the deal would bring significant economic benefits, including a £4.8bn annual boost to UK businesses, creating more jobs, wage increases of more than £2bn a year, and lower consumer prices.

Impact on UK Workers and the Economy

The primary concern remains whether the deal will undercut UK workers, as Indian workers may have a competitive edge due to the reduced National Insurance burden. Critics argue that this deal could result in fewer opportunities for UK workers and potentially lower wages, particularly in industries already struggling due to economic pressures and changes in international trade dynamics.

The UK-India trade deal, a landmark agreement between the two nations, has sparked significant debate in the UK. While it promises substantial financial benefits and aims to enhance trade relations, the extension of the National Insurance exemption has become a point of contention, raising questions about its potential long-term effects on British workers and businesses. The full implications of the deal remain to be seen as the UK government faces growing scrutiny from both opposition parties and public figures.

For further details, clarification, contributions, or any concerns regarding this article, please get in touch with us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries.