🎧 Listen to This Article

With the city-state heading into its final days of campaigning ahead of General Election 2025, two of the country’s most prominent political figures clashed Tuesday night over fiscal policy and the broader narrative shaping voter sentiment.

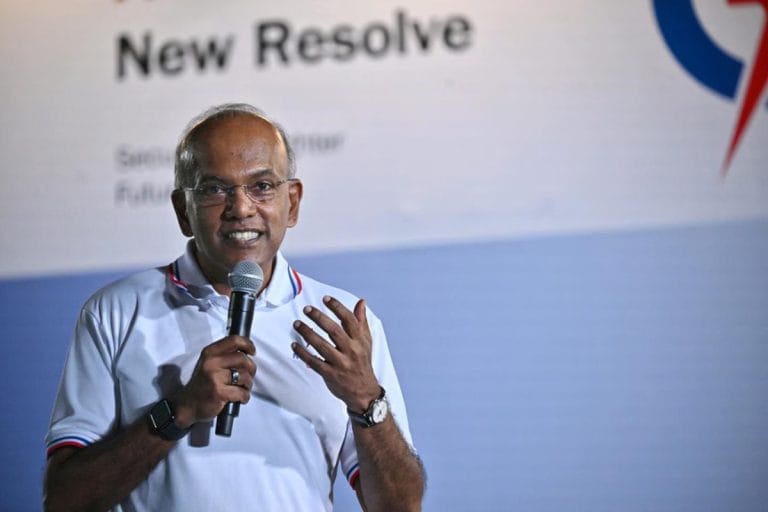

In a spirited address at the People’s Action Party (PAP) rally held at Yishun Stadium, Law and Home Affairs Minister K. Shanmugam vigorously defended the government’s decision to raise the Goods and Services Tax (GST) in 2023 and 2024, countering opposition claims that the increases were both avoidable and regressive.

“Most Singaporean households will receive more in government support than they pay in GST,” Shanmugam asserted, referencing the Ministry of Finance’s data that shows targeted transfers such as the enhanced GST Voucher scheme, CDC vouchers, and U-Save rebates effectively neutralize or even exceed the net GST outlay for lower- and middle-income households.

Revenue Needs Amid Demographic Transition

Singapore increased its GST in two phases—from 7% to 8% in 2023, and to 9% in 2024. The government argued the move was essential to fund rising healthcare and social spending driven by an aging population. Healthcare expenditure alone is projected to nearly double by 2030, reaching over S$27 billion annually. Meanwhile, the country’s dependency ratio continues to rise, with only 2.3 working adults supporting each elderly citizen, down from 5.4 in 2000.

Shanmugam emphasized the importance of long-term fiscal sustainability and warned that dipping further into Singapore’s national reserves, as suggested by some opposition parties, would compromise the principle of generational equity.

“The returns from our reserves fund vital national programs every year through the Net Investment Returns Contribution (NIRC). They’re not a blank cheque,” he stated, referring to the constitutional rule that allows the government to spend up to 50% of the long-term expected real returns on the reserves managed by GIC, Temasek Holdings, and the Monetary Authority of Singapore.

Pritam Singh Pushes Back: ‘PAP Doesn’t Walk the Talk’

In a pointed rebuttal at a Workers’ Party (WP) rally the same evening, opposition leader Pritam Singh rejected Prime Minister Lawrence Wong’s earlier remarks accusing the WP of engaging in “negative politics.” Singh defended his party’s record as a “rational and responsible” opposition force that raises difficult but necessary questions about government policy and priorities.

“The PAP says it wants unity, but it labels legitimate policy disagreements as divisive. That’s not unity. That’s political gatekeeping,” Singh told supporters in Aljunied GRC.

Singh has consistently argued that the government should prioritize re-evaluating major infrastructure projects and rebalancing fiscal assumptions before imposing broad-based tax increases. The WP has also proposed raising wealth and capital gains taxes; an idea the PAP has so far resisted.

A Question of Political Trust and Economic Trade-offs

The GST debate underscores a broader philosophical divide in Singapore’s politics: the PAP’s focus on prudence, reserves accumulation, and universal contributions versus the WP’s emphasis on equity, transparency, and alternative funding sources.

While polls still show the PAP maintaining a comfortable lead ahead of the May 3 election, voter frustration over rising costs of living, stagnating wage growth in certain sectors, and perceived over-caution in fiscal policy has given the opposition room to mobilize urban and younger voters.

Moreover, Singapore’s inflation rate, while down from its 2022 peak, remains a concern. Core inflation remains sticky at 3.4% as of March 2025, and analysts expect the GST hike to continue exerting mild upward pressure on service and retail prices throughout the year.

Implications for Policy Post-Election

Economists say the next government, regardless of its composition, will face the tough task of balancing fiscal integrity with social equity. Calls for increased transparency on how reserves are managed and what share can responsibly be drawn down are likely to intensify, particularly if economic growth slows.

Singapore’s GDP is projected to expand by 2.1% this year, slightly below the 10-year average, as the country grapples with global economic headwinds, tighter labour markets, and trade frictions in the region.

“Any tax regime must be evaluated not just on what it collects but on what it enables,” says Dr. Selena Yeo, a public finance lecturer at NUS. “Trust in institutions depends not only on sound numbers, but on how equitably and transparently policy burdens are shared.”

As Singaporeans prepare to cast their votes this Friday, the GST debate is shaping up to be more than just a fiscal issue; it is a referendum on how the country chooses to balance prudence with empathy, and tradition with transformation.

For further details, clarification, contributions, or any concerns regarding this article, please get in touch with us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries.