🎧 Listen to This Article

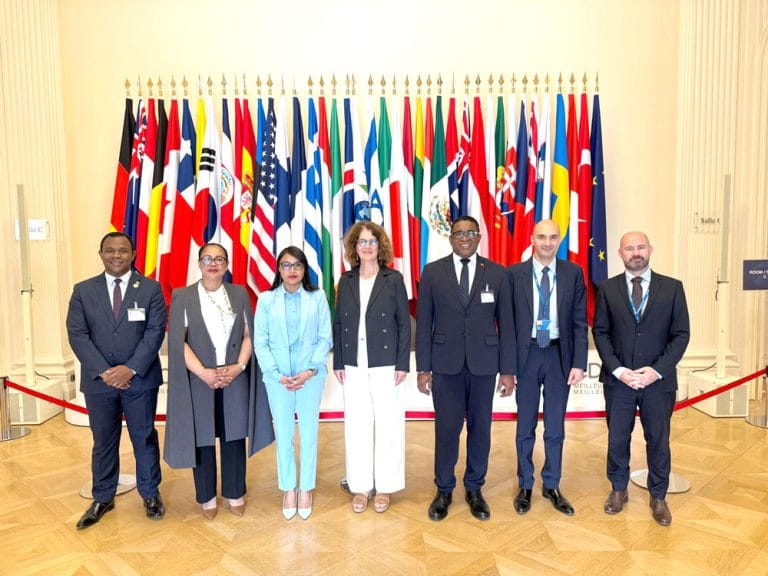

Last week, on July 28, 2025, Madagascar made a decisive move in modernizing its tax system by formally depositing its instrument of ratification of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (MAAC) in Paris, through the Ministry of Economy and Finance and the General Directorate of Taxes (DGI). Developed jointly by the OECD and the Council of Europe, this convention is widely recognized as the most comprehensive legal framework for international tax cooperation, enabling information exchange, joint audits, assistance in recovery, and cross-border notifications of tax documents.

From the perspective of an international taxpayer doing business in Madagascar or holding assets there, this development is significant. The MAAC ratification aligns Madagascar with global standards of transparency and cooperation, similar to the Common Reporting Standard (CRS) that has already reshaped international tax reporting obligations. While CRS focuses primarily on the automatic exchange of financial account information, MAAC provides the legal infrastructure to support broader tax cooperation, including on-demand and spontaneous information exchange, joint audits, and assistance with tax collection.

What this means in practice for taxpayers:

- Enhanced transparency: Financial institutions operating in Madagascar will now be required to cooperate more closely with foreign tax authorities. International clients with investments or accounts in Madagascar can expect that information could be exchanged automatically or upon request in accordance with the MAAC framework.

- Broader applicability: Unlike CRS, which is limited to financial accounts, MAAC covers a wider array of tax matters, including direct and indirect taxes. This means that businesses with operations, subsidiaries, or significant transactions in Madagascar should anticipate greater scrutiny and reporting requirements.

- Joint audits and compliance monitoring: Multinational enterprises may be subject to joint audits coordinated between Madagascar and partner jurisdictions. This enhances tax authorities’ capacity to detect underreported income or misalignment with transfer pricing rules.

- Legal certainty for taxpayers: While the compliance requirements increase, the ratification also brings clarity and formal procedures for cross-border cooperation. Taxpayers benefit from standardized processes for notifications, appeals, and information requests, reducing ambiguity in international dealings.

- Alignment with global norms: For international investors, this signals Madagascar’s commitment to modern, transparent, and internationally aligned tax administration. It also strengthens trust in the jurisdiction as a responsible player in the global financial system.

For businesses and high-net-worth individuals, the takeaway is clear. Adherence to both CRS and emerging MAAC-related reporting obligations will be essential. Financial institutions, particularly banks and investment firms operating in Madagascar, must be prepared to collect, maintain, and when legally requested, share information with partner jurisdictions.

While this development may initially appear as an additional compliance step, in reality, it represents Madagascar’s progressive approach to integrating its tax system with global standards, promoting transparency, professionalism, and predictable administration. For the international taxpayer, it is an invitation to align practices proactively and ensure all reporting obligations, whether under CRS, MAAC, or local regulations, are met accurately and timely.

In short, Madagascar is joining the ranks of countries taking serious steps to modernize and internationalize tax administration, and for those with cross-border interests, this is both a responsibility and an opportunity to engage with a more transparent and cooperative system.

For any questions, clarifications, feedback, or contributions regarding this article, please contact us at editorial@tax.news. We welcome your input and are dedicated to delivering accurate, timely, and insightful tax news. All inquiries will be handled confidentially in accordance with our privacy policy.