🎧 Listen to This Article

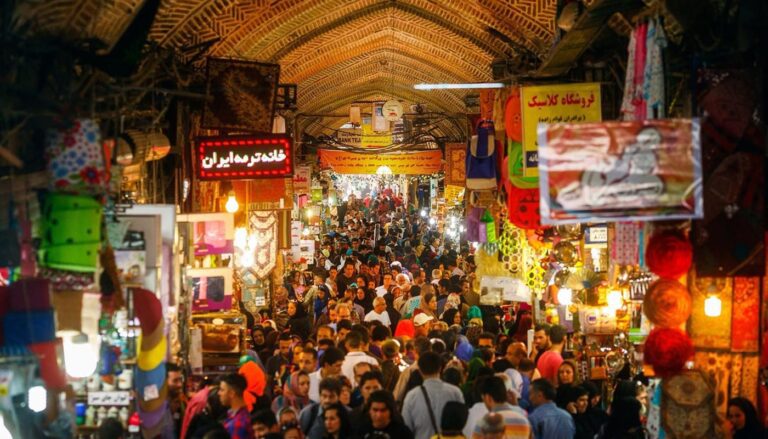

Tehran, Iran – To address severe economic challenges and expanding budget deficits due to international sanctions, Iranian authorities are implementing an electronic coupon system while increasing taxes on various sectors. This dual strategy is set against escalating inflation burdening the average Iranian citizen.

As the festive period of Nowruz, marking the Persian New Year, approaches, President Masoud Pezeshkian’s administration is reviving a system of electronic coupons, initially used during tough economic times in the past, including World War II and the aftermath of the 1979 revolution. This revival, however, comes hand-in-hand with substantial tax increases aimed at enhancing state revenue.

Details of the Coupon System

Starting this week, low-income and middle-class Iranians can access up to 5 million rials (approximately $5) for purchasing essential grocery items including red meat, chicken, eggs, milk, cooking oil, rice, and sugar at government-subsidized prices.

About 60 million individuals are eligible for this assistance, which aims to temporarily alleviate the financial strain faced by families grappling with decreasing purchasing power caused by years of economic mismanagement and harsh sanctions.

The electronic coupon initiative is not new; prior governments, including that of former President Ebrahim Raisi, also relied on similar programs in response to inflationary pressures. In total, every administration has faced the pressing need to diversify revenue sources away from an over-reliance on oil revenues—especially impacted by aggressive U.S. sanctions.

Tax Increases to Boost Government Revenues

According to reports from Iran’s Parliament Research Center, the nation anticipates a dramatic 53% increase in total government tax revenues for the upcoming fiscal year.

Key highlights include:

- A projected 73% increase in corporate income tax revenues.

- A 68% rise in individual income tax collections.

- An 85% spike in taxes on imports, particularly for vehicles following the repeal of a long-standing import ban.

Escalating Costs for Government Services

In addition to tax hikes, the forthcoming budget will see increased fees for essential government services impacting both Iranian citizens and foreign nationals residing in the country.

Notable changes include:

- Increased costs for national ID and passport issuance.

- Higher registration fees for vehicles and motorcycles.

- Increased fines for traffic violations, poised to escalate further in light of heightened travel around Nowruz.

These changes will particularly affect the estimated six million Afghan refugees and migrants residing in Iran, as Tehran Municipality plans to raise service costs aimed at foreign nationals by 54% in the upcoming year.

Navigating Economic Challenges

The Iranian government’s multifaceted approach—including higher taxes and the electronic coupon scheme—underscores a desperate effort to pull the economy from the brink while balancing the acute needs of its citizens during a time of national hardship.

With inflation straining daily life and the economic landscape in constant flux, these policy updates represent just one of many ongoing attempts to stabilize the Iranian economy and support its people.

For further details, clarification, contributions or any concerns regarding this article, please feel free to reach out to us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that all inquiries will be handled in accordance with our privacy policy