🎧 Listen to This Article

In a significant move to strengthen Sino-Egyptian economic relations, Egypt’s Tax Authority held a strategic meeting with the Chinese Chamber of Commerce in Egypt, organized by Huawei Egypt, focusing on Egypt’s evolving tax policies and investment environment.

During the event, Rasha Abdel Aal, Head of the Egyptian Tax Authority, highlighted the pivotal role of Chinese companies in Egypt’s economic landscape, emphasizing the country’s readiness to provide comprehensive support for expansion and growth. She proposed the formation of a permanent joint committee between the Tax Authority and the Chinese Chamber of Commerce to deepen partnership and enhance economic cooperation.

“Chinese enterprises are strategic partners in Egypt’s business ecosystem,” said Abdel Aal. “Our objective is to build a new chapter with the business community—one rooted in partnership, certainty, and sustainable development.”

Key Announcements and Reform Highlights

Abdel Aal detailed recent tax incentives and structural reforms introduced under Laws 5, 6, and 7 of 2025, which aim to:

- Resolve pending tax disputes

- Create a simplified and integrated tax regime for SMEs

- Attract more foreign direct investment (FDI)

- Transition toward digital and transparent fiscal governance

A simplified tax regime was introduced for businesses with annual revenues under EGP 20 million, offering relative tax rates starting at 0.4% and maxing at 1.5%, along with free access to technical support and POS devices for small businesses.

Other initiatives include:

- A Pre-Ruling Unit to offer binding guidance to investors

- A Grievance Unit to expedite taxpayer issue resolution

- An enhanced central clearing system and a VAT refund mechanism, reducing refund processing time to an average of 22 days

Legal Reform and Investor Support Tools

Dr. Ashraf El-Zayat, Head of Audit Sector, underscored Law 5/2025 as a catalyst for formalizing the informal economy. The law allows businesses to register without backdated penalties and submit or amend tax declarations retroactively (2020–2025) with no fines or sanctions.

Saeed Fouad, Advisor to the Tax Authority Chief, added that standardized audit manuals and multilingual investor guides are now available on the Authority’s website, with an English-language platform set to launch soon to further improve tax transparency and cross-border investor awareness.

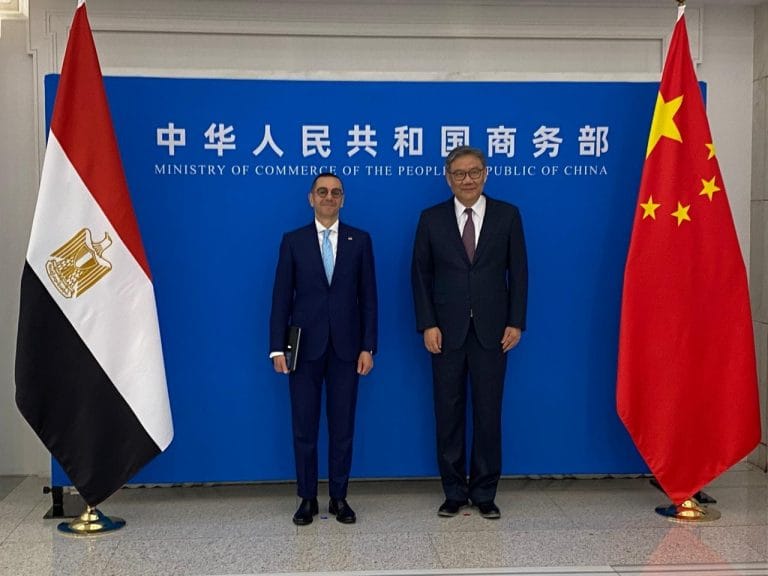

Strengthening Bilateral Economic Ties

Zhang Wei Cai, Chairman of the Chinese Chamber of Commerce in Egypt, praised Egypt’s tax modernization efforts and highlighted the Suez Canal Economic Zone as a model for sustainable development. He stated that the Chamber has helped create over 100,000 jobs in Egypt, emphasizing the need to expand cooperation in clean energy sectors including solar, wind, and renewables, supporting Egypt’s green transition agenda.

“Egypt represents an inspiring model for developing nations. We thank the Egyptian Tax Authority for their support, and we look forward to deepening collaboration across energy and industrial sectors,” said Zhang.

For further details, clarification, contributions, or any concerns regarding this article, please get in touch with us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries.