🎧 Listen to This Article

BEIJING – China will raise its tariffs on U.S. goods to a staggering 84% starting April 10, escalating tensions in the renewed US-China trade war just hours after former President Donald Trump reimposed 104% tariffs on Chinese imports. The retaliatory move signals a dramatic re-escalation of tariff diplomacy with deep implications for global supply chains, inflation, and corporate tax planning.

Markets reacted sharply. The Shanghai Composite and Dow Jones Industrial Average both fell more than 3%, while Treasury yields dipped as investors fled to safe havens. Beijing’s swift response reflects its strategy to match Washington’s economic aggression with calculated policy retaliation.

Context & Global Economic Flashpoint

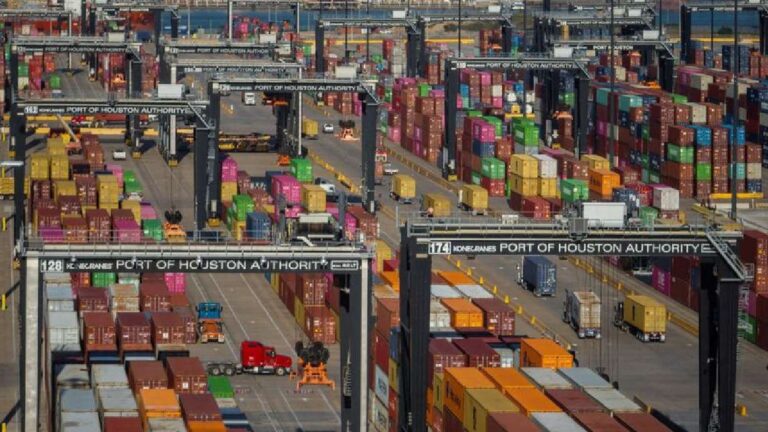

Trump’s new tariff wave, which took effect at 12:01 a.m. EST, targets $300 billion worth of Chinese goods including electronics, steel, and consumer items. Calling out “countries that are ripping off the U.S.,” Trump has reignited a policy playbook that defined his first term: tariff pressure to force trade concessions.

Beijing, in return, announced via its Ministry of Commerce that tariffs on select U.S. goods would jump from 34% to 84%, effective Thursday, with the hike targeting agriculture, semiconductors, and automotive exports.

“This is a tit-for-tat escalation we haven’t seen since 2019. The consequences for global tax and customs planning will be profound,” said Angela Xu, international trade adviser at Deloitte China.

Sectoral and Tax Implications

Multinationals Face Dual-Tariff Exposure

- U.S. companies exporting to China will now face steep cost barriers, particularly in soy, pork, and auto parts.

- Importers and manufacturers relying on Chinese supply chains may need transfer pricing adjustments, customs reclassification, and duty optimization strategies.

Corporate Tax and Pricing Consequences

- Tariffs will distort transaction pricing, requiring adjustments under OECD Transfer Pricing Guidelines to avoid double taxation.

- Companies may reevaluate base erosion protections and assess VAT credits lost through re-routed trade flows.

WTO and Treaty Risks

- China’s tariff hike raises the prospect of renewed litigation at the World Trade Organization (WTO), potentially fracturing fragile global tax cooperation frameworks.

- Analysts warn this could chill ongoing OECD Pillar One and Pillar Two negotiations, especially for digital services taxation and global minimum tax alignment.

Strategic Response and Forward Outlook

Corporates are advised to:

- Map supply chain vulnerabilities and revisit customs valuation methodologies.

- Use Advanced Pricing Agreements (APAs) to shield intercompany transactions.

- Prepare for countermeasures by ASEAN and EU trade partners caught in the crossfire.

“This could create the most significant tariff-induced tax shock since 2018,” noted John Carmichael, international tax policy lead at KPMG US. “We expect companies to accelerate restructuring to mitigate exposure.”

What to Watch

- April 10: China’s tariffs officially go into effect. Watch for port delays and immediate customs revaluation disputes.

- Q2 Earnings Reports: Look for disclosure of tariff-driven pricing impacts and tax provisioning in earnings calls.

- WTO Filings: Possible U.S. or Chinese complaints could reshape trade legality debates.

- G20 Osaka Talks (June 2025): Potential diplomatic inflection point.

For further details, clarification, contributions, or any concerns regarding this article, please contact us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries