🎧 Listen to This Article

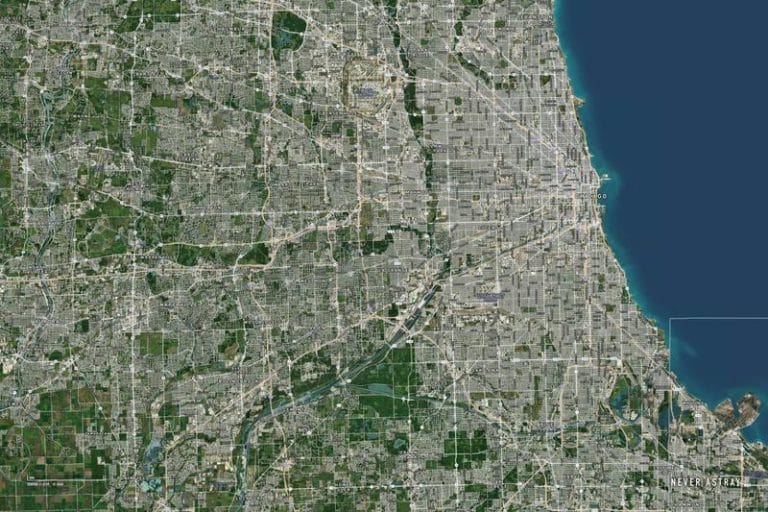

Chicago homeowners are facing the steepest rise in property taxes in at least three decades, according to a new analysis from the Cook County Treasurer’s Office. The study also found that the financial burden is falling most heavily on communities of color across the South and West sides.

The Treasurer’s Office reported that the median residential property tax bill across the city jumped by more than 16 percent. Officials attribute the surge to higher city spending paired with a shrinking commercial tax base. The continued decline in the value of downtown commercial buildings has significantly reduced the sector’s tax contribution.

Treasurer Maria Pappas said downtown office towers are paying about 129 million dollars less this tax cycle because of falling valuations and persistent vacancies. She noted that the commercial market has been slow to recover, leaving homeowners to absorb the difference.

Pappas said many office buildings have remained unrented for years, causing their tax assessments to drop. Residential properties have been forced to pick up the slack, resulting in substantial increases for many homeowners.

Communities of Color Carrying the Heaviest Burden

The study indicates that majority Black and Latino neighborhoods are experiencing the most dramatic spikes. In West Garfield Park, bills rose by 133 percent. In North Lawndale, taxes increased by 99 percent. Englewood saw increases of more than 80 percent.

According to Pappas, many homes in these neighborhoods may have been undervalued in previous assessment cycles. The most recent reassessment, which occurs every three years, brought taxable values more in line with market conditions and contributed to the sharp increases.

Bills Due December 15

Homeowners who have not yet received their tax bills can access them online, where they can also make payments. Taxes are due on December 15. The Treasurer’s Office noted that homeowners who cannot pay the full amount immediately can set up a payment plan with interest.

For any questions, clarifications, feedback, or contributions regarding this article, please contact us at editorial@tax.news. We welcome your input and are dedicated to delivering accurate, timely, and insightful tax news. All inquiries will be handled confidentially in accordance with our privacy policy.