🎧 Listen to This Article

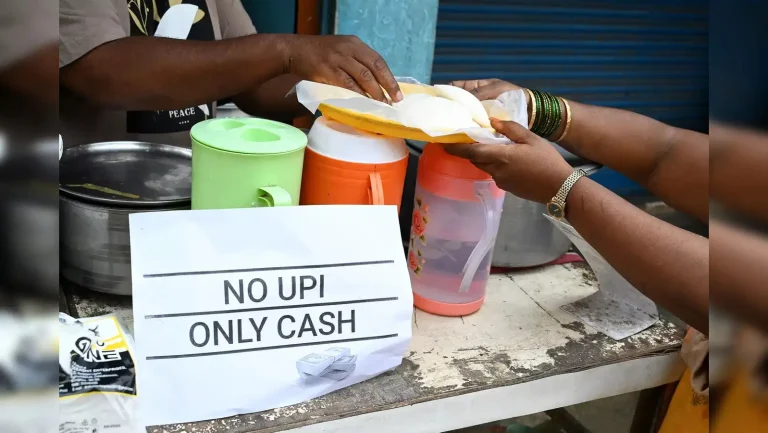

A growing number of small traders and shopkeepers in Bengaluru have begun refusing Unified Payments Interface (UPI) transactions, citing concerns over increased scrutiny from the Goods and Services Tax (GST) Department. Signs reading “No UPI, Only Cash” have become commonplace across markets and roadside stalls in India’s tech capital, as vendors seek to avoid potential tax liabilities and notices.

This trend reflects a deeper anxiety among micro and small enterprises about the visibility that digital payments provide to tax authorities, particularly in the wake of recent GST enforcement actions based on UPI transaction data.

What’s Prompting This Shift?

According to a report by The Economic Times, multiple vendors, including unregistered traders and small proprietors, have received GST notices citing digital transaction records—some of which reportedly involve tax liabilities running into several lakh rupees.

These notices have triggered fears of retrospective tax audits, penalties, and in extreme cases, possible eviction or shutdowns, particularly for those operating informally or on public land.

GST Thresholds: When Must Vendors Register?

Under Section 22 of the CGST Act, 2017, registration under GST is mandatory if:

- Annual turnover exceeds ₹40 lakh for businesses engaged in goods supply (₹20 lakh for select states and special categories)

- Annual turnover exceeds ₹20 lakh for businesses providing services

Digital transactions—whether via UPI, POS (point-of-sale) machines, NEFT/RTGS, wallets, or direct bank transfers—can collectively serve as an audit trail, enabling tax authorities to assess actual turnover. Cash payments are also liable if they contribute to taxable turnover above the threshold.

Government Clarification: UPI Alone Is Not the Basis for GST Notices

In response to growing public concern, Karnataka’s Commercial Taxes Department clarified that GST notices were issued only where aggregate turnover (regardless of payment mode) exceeded the prescribed threshold.

A recent press release emphasized:

“The GST is applicable on the consideration received for the supplies in any form, and UPI is only a method of receiving such consideration. The department will take suitable action to collect the applicable tax under the GST Act from traders who have received consideration in any form.”

This means vendors cannot avoid GST obligations simply by refusing digital payments. All income—digital or cash—is subject to GST once the threshold is crossed.

Burden of Proof: What the Law Says

According to Section 101A of the GST Act, the burden of proof for establishing a tax liability lies with the tax authority. HD Arun Kumar, former Additional Commissioner of Commercial Taxes, reaffirmed this in comments to ET:

“Under the GST laws, the burden of proof is on officers. They must establish it before arriving at a tax demand, unlike in money laundering cases.”

In practice, this means the department must demonstrate that the trader’s aggregate turnover exceeds the threshold, based on credible evidence—not merely a few UPI transactions.

Pressure to Raise Revenue

Karnataka’s tax enforcement push comes amid a significant revenue collection target of ₹1.2 lakh crore for FY 2025–26. At the same time, the state government is under fiscal strain, balancing ₹52,000 crore in welfare guarantees with infrastructure demands from legislators.

Some experts warn that if tax authorities in Bengaluru succeed in extracting substantial back taxes from small traders through digital trails, other states may follow suit, further pushing small vendors back into cash-dominated systems.

Implications for Policy and Compliance

This incident highlights a persistent compliance gap in India’s informal sector, where many small traders remain outside the GST net but conduct business at volumes potentially exceeding statutory limits.

Tax professionals advise small vendors to:

- Maintain accurate records, regardless of payment mode

- Aggregate all revenue sources (cash and digital) when assessing GST applicability

- Seek professional advice before opting out of digital payments or reacting to GST notices

The shift away from UPI may represent a short-term workaround, but it underscores the need for simplified compliance regimes, better taxpayer education, and a less adversarial enforcement approach—especially for micro and small businesses.

For further details, clarification, contributions, or any concerns regarding this article, please get in touch with us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries.