🎧 Listen to This Article

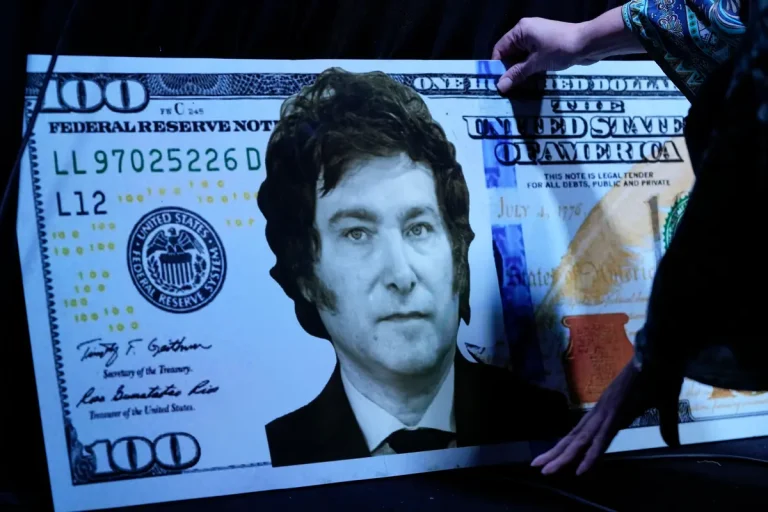

In an unprecedented fiscal maneuver, Argentine President Javier Milei’s administration has proposed a sweeping tax reform aimed at unlocking what economists estimate to be over US$260 billion in undeclared cash savings, much of it stashed in mattresses, safety boxes, and offshore accounts. The new legislative proposal, formally titled “Ley de Principio de Inocencia Fiscal” (Fiscal Presumption of Innocence Law), promises legal protection for individuals who regularize their assets, ending what the government calls the “criminalization of savers.”

But is this reform a long-overdue modernization or a fiscal whitewash that rewrites Argentina’s relationship with capital transparency?

The “Mattress Dollar” Economy: A Shadow Giant

For decades, Argentines have distrusted their own currency and banking system. Chronic inflation, exchange rate controls, and cyclical financial crises created a parallel economy where dollars are hoarded and hidden, not declared or invested.

According to private estimates, undeclared cash held by Argentines could surpass 50% of the country’s GDP.

Milei’s plan dubbed the “Historical Reparation of Argentines’ Savings,” aims to normalize these savings by ensuring that individuals will not face criminal charges if they disclose or use them.

Key Tax Changes: Amnesty and Simplicity

ARCA tax bureau chief Juan Pazo laid out two pillars of the bill:

1. Increased Tax Evasion Thresholds

- Before this reform, discrepancies over 1.5 million pesos (~US$1,200) could trigger criminal prosecution.

- The new bill raises thresholds significantly, shrinking active tax crime cases from 7,000 to under 200.

- The statute of limitations on audits was reduced from 5 to 3 years for compliant filers.

2. New “Simplified Income Tax Regime”

- Taxation will be based solely on invoiced earnings.

- Net worth, spending, and asset growth will not be taxed.

- Example: Buying five properties in a year? As long as declared income aligns with invoices, no further scrutiny exists.

This approach shifts Argentina from a net-worth-based tax regime to a transactional earnings-based model, a radical departure from global norms.

Legal Immunity for the Past

Participants who opt into the new regime will be granted permanent immunity from retroactive audits or penalties. In other words, the law offers de facto amnesty for decades of undeclared assets.

Cabinet Chief Guillermo Francos confirmed that even savings of up to 50 million pesos (~US$43,000) will be protected.

“No administration addicted to persecution will be able to treat decent Argentines like criminals ever again,” said Pazo.

De-Risking Financial Transparency?

Critics argue the bill sets a dangerous precedent. By legalizing decades of financial opacity, it may:

- Undermine efforts to combat money laundering and tax evasion.

- Erode international credibility, especially with FATF and OECD compliance frameworks.

- Create moral hazard: incentivizing noncompliance under the assumption of future amnesties.

On the other hand, supporters hail it as a necessary reboot to mobilize capital, restore trust, and reduce regulatory overreach.

Federal Adoption & Financial Reform

- 13 provinces and Buenos Aires City have signed on.

- ARCA has doubled the cash deposit threshold without identity disclosure to US$10,000.

- Real estate and auto registry reporting requirements eased to exclude transactions below US$100,000.

Takeaways for Global Tax Observers

Argentina’s reform illustrates a bold experiment in fiscal pragmatism, shifting from punitive enforcement to incentivized disclosure.

Key global takeaways:

- Soft amnesty can unlock capital, but risks long-term compliance erosion.

- Threshold inflation must be accompanied by robust digital audits.

- Future administrations must resist political reversal, or risk credibility collapse.

For further details, clarification, contributions, or any concerns regarding this article, please get in touch with us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries.