In a significant move toward modernizing its tax administration, the Federal Board of Revenue (FBR) of Pakistan has signed an agreement with Karandaaz Pakistan aimed at transforming the organization into a fully digital entity. This initiative coincides with the vision of the Prime Minister, who seeks to enhance the automation of processes and advance the digitalization of the economy. By embracing these changes, the FBR aims to streamline compliance for taxpayers, improve economic documentation, broaden the tax base, and create sustainable revenue growth.

A Strategic Collaboration for Digital Innovation

The collaboration between FBR and Karandaaz will focus on developing a comprehensive digital strategy tailored to the unique needs of the FBR. The initiative will assess the current IT infrastructure, business processes, and specific requirements necessary for implementing a more efficient tax system in Pakistan. By employing service-oriented and taxpayer-centric use cases, the goal is to ensure that all aspects of the digital taxation framework are aligned with modern market needs.

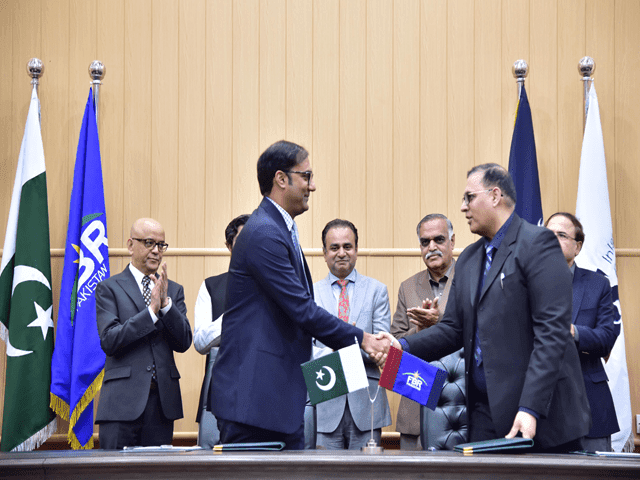

At the agreement’s signing ceremony, FBR Chairman Mr. Malik Amjed Zubair Tiwana emphasized the agency’s commitment to embracing digital solutions. He noted that the FBR has taken proactive steps to tackle issues surrounding the undocumented economy and is keen on expanding the tax base. This partnership with Karandaaz marks a strategic step toward achieving the digital transformation of FBR and enhancing its operational capacity.

Emphasizing a People-Centric Approach

During a meeting with FBR officials earlier that day, Finance and Revenue Minister Mr. Muhammad Aurangzeb underscored the critical importance of a business and people-centric approach in the development of these digital tools. He highlighted the immense potential of this initiative, which can be maximized only with the involvement of skilled professionals capable of designing and implementing effective digital solutions. He recommended engaging experienced international consultants known for their success in tax digitization projects within similar frameworks.

Building a Robust Digital Ecosystem

Mr. Waqas ul Hasan, CEO of Karandaaz Pakistan, expressed enthusiasm about the initiative, noting that it aligns with the digital public infrastructure objectives set forth by the Bill and Melinda Gates Foundation, one of Karandaaz’s key sponsors. The successful transformation of the FBR will place taxpayers at the heart of the system, resulting in an agile and resilient tax administration. The benefits of this digital evolution are expected to extend to the entire nation, enhancing overall economic prosperity.

This pivotal agreement was officially signed on March 15th, 2024, by Mr. Ardsher Salim Tariq, Member (Reforms and Modernization) of FBR, and Mr. Sharjeel Murtaza, Director of Digital Services at Karandaaz Pakistan.

The partnership between FBR and Karandaaz marks a momentous step towards fostering a digital ecosystem in Pakistan’s tax administration. By prioritizing modernization, efficiency, and a taxpayer-focused approach, both organizations aim to revolutionize the way taxation is managed in the country, making it more sustainable for the future.

For further details, clarification, contributions or any concerns regarding this article, please feel free to reach out to us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that all inquiries will be handled in accordance with our privacy policy