🎧 Listen to This Article

As tax season barrels toward its final stretch, millions of Americans face a familiar deadline: Tuesday, April 15, 2025. That’s when individual tax returns for the 2024 tax year are due to the Internal Revenue Service (IRS). And for those still scrambling to get their documents in order, a timely extension may offer a much-needed reprieve — though it doesn’t come without conditions.

Whether you’re a self-employed professional still awaiting key 1099s, a disaster-area resident eligible for IRS relief, or simply among the millions delaying due to financial stress, understanding the rules around the 2025 tax deadline is essential to avoid penalties.

Learn About Last-Minute Tax Tips: Maximize Your Savings Before the April 15 Deadline

April 15 Remains the Standard Filing Deadline

Unless you live in one of the federally declared disaster zones, most Americans are required to file their federal income taxes by April 15, 2025. The IRS has already processed more than 101 million individual returns as of early April and anticipates over 140 million filings by season’s end.

Disaster Relief: Extended Deadlines in 12 States

However, not everyone faces the same deadline. Due to severe storms, hurricanes, wildfires, and other natural disasters, the IRS has granted automatic filing and payment extensions to affected taxpayers in 12 states. These include:

- California wildfire victims: Extended deadline until October 15, 2025

- Hurricane-affected areas in Florida, Georgia, the Carolinas, Alabama, Tennessee, and Virginia: New deadline is May 1, 2025

- Severe weather zones in Alaska (Juneau), New Mexico (Chaves County), and Kentucky: Extended deadlines through May 1 or November 3, depending on location

Affected taxpayers do not need to apply for relief. The IRS determines eligibility based on addresses listed in the disaster declarations.

What Is a Tax Extension?

For all other taxpayers, a federal tax extension grants an additional six months to file your return — pushing your personal filing deadline to October 15, 2025. However, an extension does not delay the deadline for payment. Taxes owed are still due by April 15, and failure to pay on time may result in interest and penalties, regardless of whether a filing extension is granted.

How to File for a Tax Extension in 2025

There are three primary ways to file for an individual tax extension:

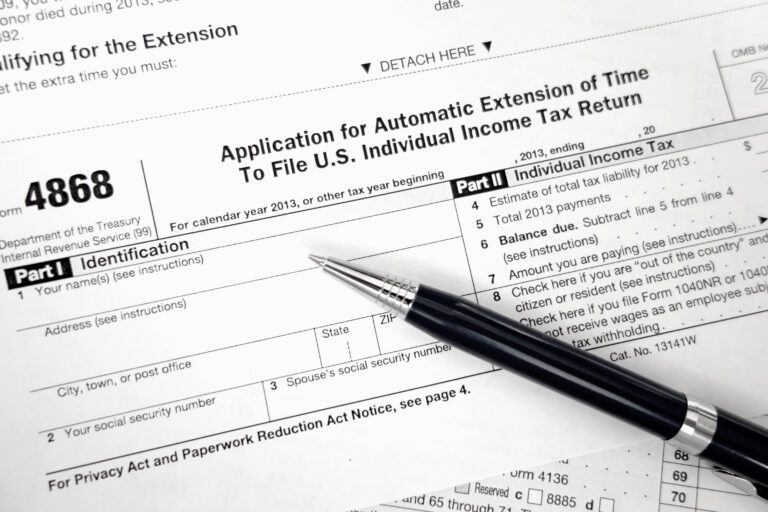

- IRS Free File: Available on IRS.gov, this lets you submit an extension electronically using Form 4868 — the “Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.”

- Online Payment Option: When making a payment on the IRS website (via debit, credit, or direct transfer), taxpayers can indicate the payment is for an extension — eliminating the need to file Form 4868 separately.

- Tax Professional or Software: Most tax software platforms and professional preparers offer electronic extension filing. Form 4868 can also be filed by mail.

Business entities use Form 7004 for corporate or partnership filing extensions.

Deadline to File an Extension: April 15, 2025

To be valid, Form 4868 (or its electronic equivalent) must be submitted by April 15, the same day your taxes are originally due. There’s no cost to file for an extension, but you should estimate and pay any taxes owed by this deadline to avoid penalties.

Who Benefits Most from an Extension?

Experts say extensions are most useful for:

- Self-employed taxpayers still awaiting final income statements

- Investors needing more time to reconcile brokerage documents or K-1s

- High-net-worth individuals involved in complex tax scenarios

- Taxpayers under financial stress who may need time to organize or verify records

“Filing for an extension is often the most prudent move,” says Tyler Horn, Head of Planning at Origin. “Mistakes from rushing can lead to audits or missed deductions — and that’s a cost no one wants.”

A recent Harris Poll conducted on behalf of Origin found that 41% of Americans have delayed filing in 2025. Financial stress, especially among Gen Z and millennials, was cited as the top reason.

Still, Horn warns: “An extension to file is not an extension to pay. The IRS is clear about that, and the interest clock starts ticking on April 16.”

Avoid Penalties: Pay on Time, File Later

Even if you’re not ready to file your full return, estimating and paying any owed tax is critical. Underpayment or late payment of tax can lead to interest charges of up to 0.5% per month, with further penalties for continued delinquency.

With tax season’s final deadline just around the corner, now is the time to act. Whether you file your return or request an extension, staying compliant with IRS rules is the best way to avoid unnecessary fines — and financial headaches later in the year.

For further details, clarification, contributions, or any concerns regarding this article, please contact us at editorial@tax.news. We value your feedback and are committed to providing accurate and timely information. Please note that our privacy policy will handle all inquiries